To help our portfolio companies navigate through the current “fog of uncertainty”, we have decided to write a series of articles in which we’ll delve into the impact of the Covid-19 sanitary crisis on our areas of expertise: energy, mobility and industry 4.0.

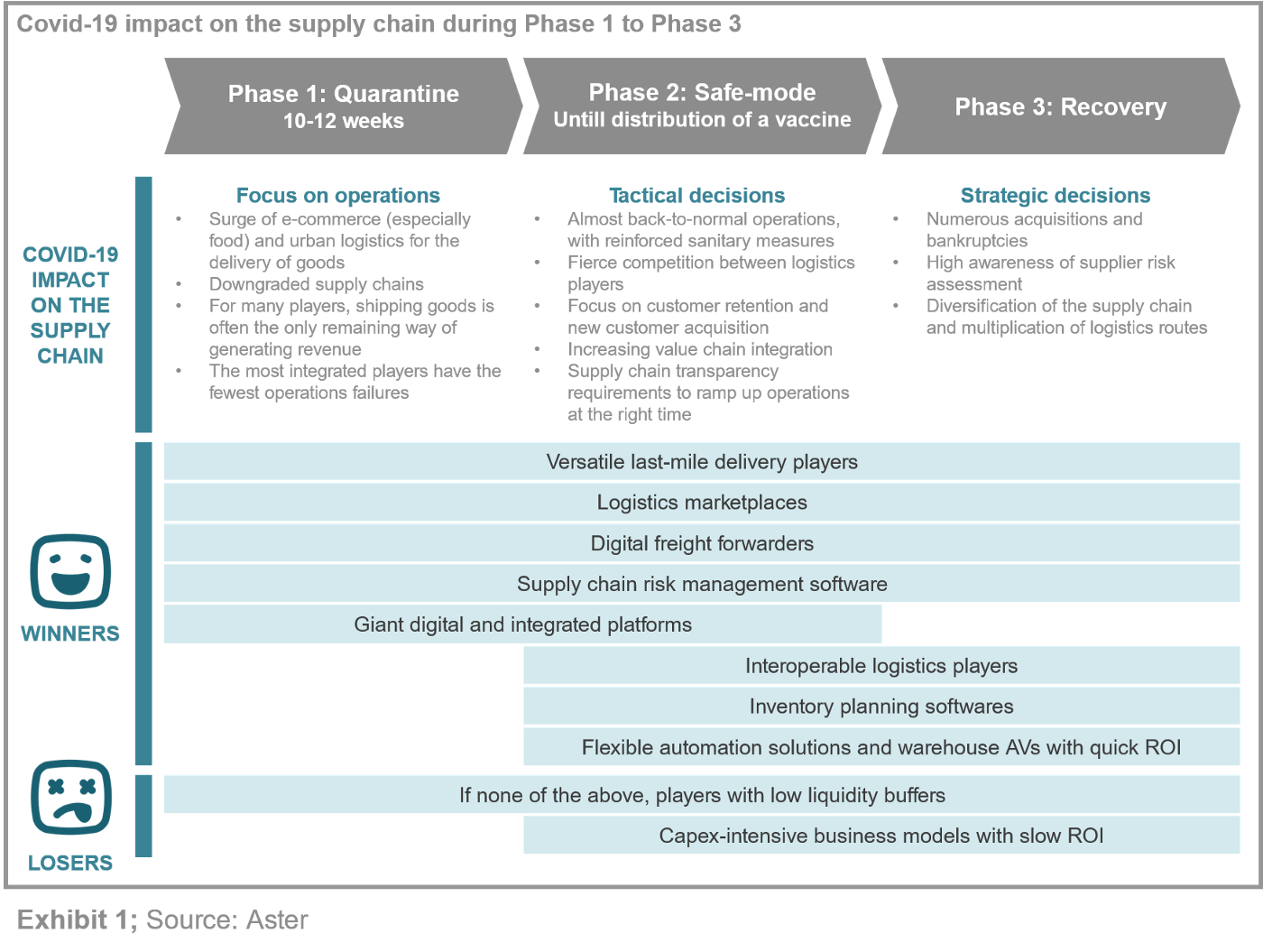

In these articles, we will analyze the impact over three different periods identified in our first article:

- Quarantine period — Fighting through the sanitary crisis (10–15 weeks in the UE)

- Safe-mode period — Learning to co-exist with Covid-19 (after quarantine)

- Period of recovery — Development and distribution of a vaccine at large scale (from 2021)

In our last article, we delved into the impact of Covid-19 on the transportation of people. In this article, we will analyze its impact on logistics and supply chains. From the other side of the world to your country, or from the warehouse to your home, logistics and supply chain players are adapting. Although, the sector is operating at a slower pace, it is perhaps the only market that is still fully operational — which makes it quite unique. That said, this crisis reveals how globalized our entire economy has become. The question is: how will Covid-19 reshape our global supply chains?

Phase 1: Quarantine period — Fighting through the sanitary crisis

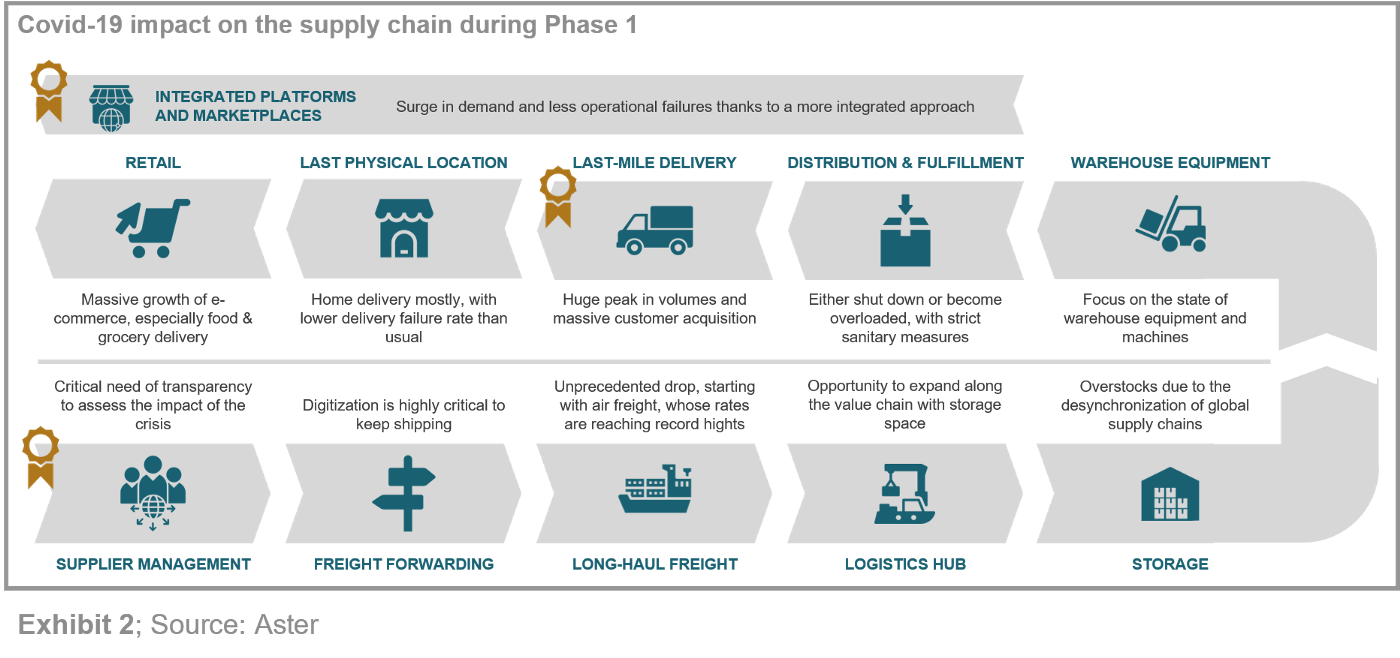

1.1. Resilient urban logistics operations keep many retailers afloat

As a result of the crisis, food & grocery delivery has become the fastest growing segment of urban logistics. According to Nicolas Breuil, Head of Marketing, Brand & Communications at Stuart, “our business with small and local food marketplaces, such as Epicery, Ollca or Rapidle, grew tenfold in March, while our business with supermarkets only doubled.” Not only do people prefer to shop online because it is safer, but they are wanting to support local shops.

Giant marketplaces with their own logistics options are also experiencing an increase in activity, as well as a decrease in operational failures. For instance, JD.com, which is managing to operate 24/7 thanks to its own logistics circuits and drivers, has seen its stock peak at $46.15 on April 17th. While its competitors, Alibaba and Pinduoduo, are forecasting a significant negative impact from the crisis as they rely exclusively on third-party sellers and fragmented distribution channels.

Finally, the physical stores which had not yet ridden the e-commerce wave were forced to implement “quick and dirty” solutions. “Stuart has partnered with iZettle [a Swedish payment startup acquired by Paypal in 2018] to help small shops like butchers and chocolate shops to stay afloat. Orders are made by phone, iZettle allows them to pay by SMS and we take care of the last-mile delivery.” added Nicolas.

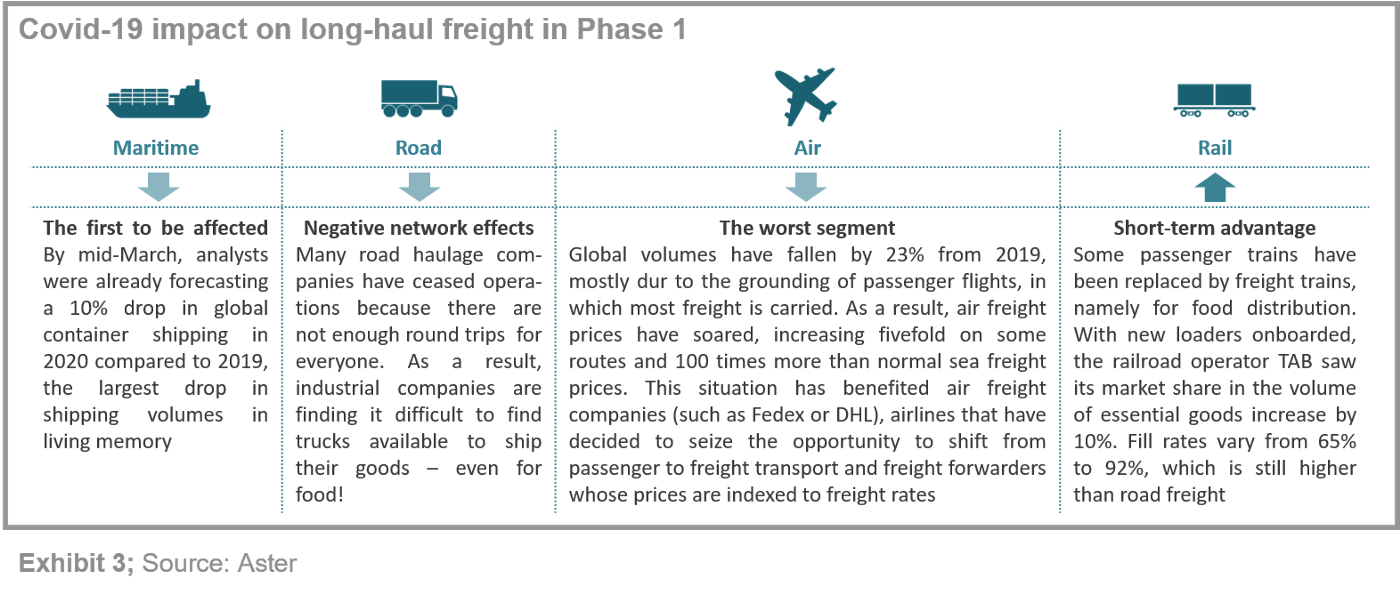

1.2. Long-haul logistics are chaotic but digitizing at a forced march

Global trade and supply chains are going through a massive shock which is striking from both the supply and demand sides. Companies, whether buyers or suppliers, are struggling to keep goods on the move at a time of global lockdown — especially with the contamination time lag between the US, Asia and Europe. “Most of our customers are overwhelmed. There is no flexible solution to absorb the peak of demand, other than the increase in workforce, which would cause additional sanitary risks.”, according to Vincent Jacquemart, CEO of iFollow.

Given that the situation changes daily, technology is playing a growing role in rebuilding the trade and supply chain and making it more shock-proof. We are seeing players digitizing at a forced march — even less digitized ones such as freight forwarders, which provide the essential link between exporters and shippers. According to Brieuc André, COO of Ovrsea, a French digital freight forwarder, “the freight veterans, who used to be digital sceptics, are now facing major issues as technology is a competitive advantage in this crisis. March has been the best month ever in terms of new customer acquisition”.

1.3. Opportunities for Supply Chain risk management solutions

According to Heiko Schwarz, CSO of Riskmethods, one of their prospects (a leading automotive supplier) had its 80 procurement employees spending their days reading newspapers to see if any of their suppliers were affected. Global supply chains are still quite opaque, and many companies do not have the means to assess the risk of business disruption.

For the first time, sales, marketing, logistics and procurement teams are having to work closely together to get a complete picture of the demand, manufacturing and supply to adapt and recover from the unanticipated supply chains disruptions that are occurring. “In four weeks, the subscription base for our Coronavirus daily updates grew from 0 to 1,000 supply chain professionals. People need this transparency as soon as possible. And it has paid off: our sales cycles have significantly sped up while the average basket has increased a lot! It’s the first time in my career that I’ve seen a marketing campaign that pays off before it’s even finished.” shared Heiko.

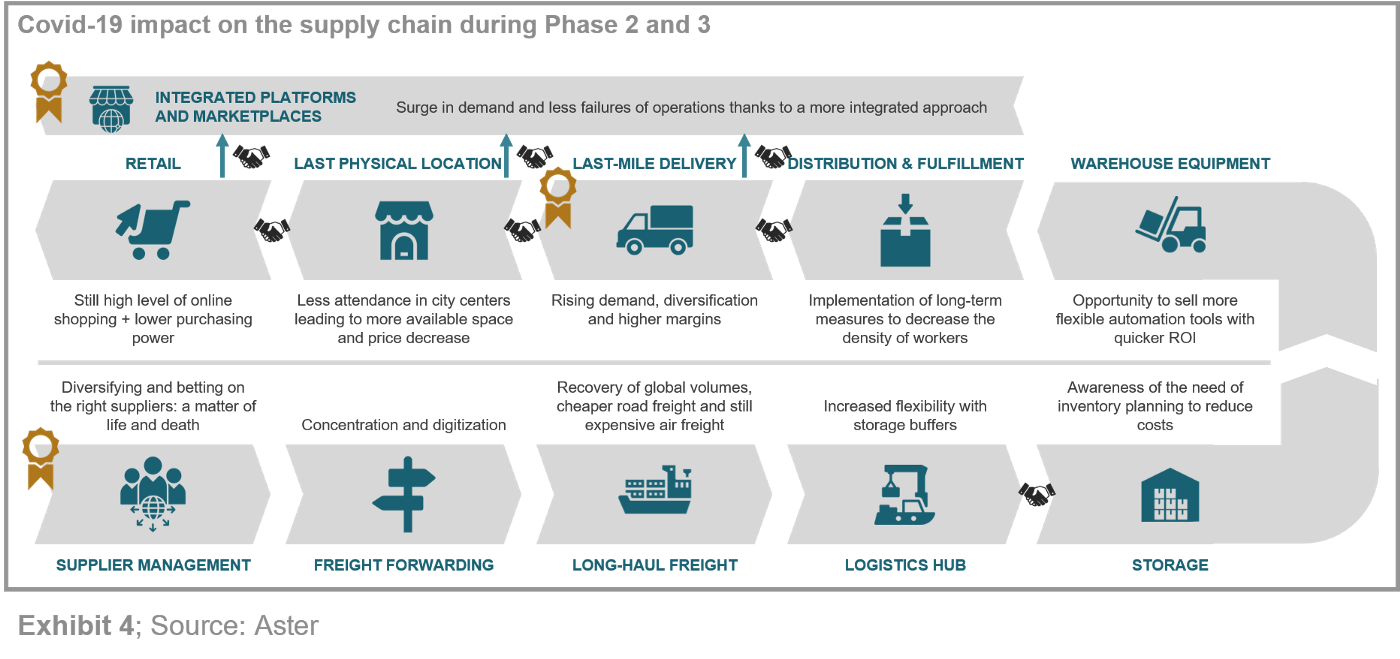

Phase 2: Safe-mode period — Learning to co-exist with Covid-19

2.1. With fiercer competition, versatile players will win

Deliveries will be in full swing at the end of the quarantine period. All pending deliveries will be secured, non-essential businesses will turn to online sales to recover as best they can, and in cities, restaurants and physical shops will likely turn into micro-fulfillment centers for last-mile deliveries in parallel with their operations. This expected growing demand for urban logistics, combined with the increasing number of urban fulfillment centers (enabling more stacking due to an increased density) will lead to increased revenues and margins, and in the end fiercer competition. Will it start a price war? Which players will achieve significant economies of scale and establish themselves as market leaders?

While they are currently affected by quarantine, the safe-mode period should also be a glorious time for food delivery platforms (Just Eat, Uber Eats, Deliveroo, etc.) with growth in both demand and supply — a large number of restaurants have been onboarded during quarantine. Some actors are even starting to deliver more than just food. This is the case of Meituan, the Chinese delivery giant, which delivers more than 10,000 products in addition to food, such as Huawei phones or even Sephora cosmetics. However, one may wonder whether food delivery platforms will start delivering parcels in Europe, given how the cost of European labour would significantly increase delivery prices.

In the long-haul segment, the plummeting of oil prices (oil prices were actually negative the second half of April) will probably revive road freight with very aggressive or even dumping strategies. Given the huge volumes of oil in storage, prices are likely to remain low for several months: rail freight may not be able to retain its new loaders onboarded during the quarantine.

2.2. Integrated players will get an edge

As JD.com proved during the quarantine phase, being more integrated ensures fewer operational failures. E-commerce enablers will be seen expanding horizontally or establishing new partnerships to provide a more integrated offering to the end customers. “We are currently talking with large e-commerce players such as Shopify, Magento and Prestashop — who also want to cover last-mile delivery “, Nicolas from Stuart.

Companies enhancing end-to-end visibility and transparency will also be flourishing. Byrd, for example, brings together fulfillment and delivery partners on one platform to provide a single logistics partner to retailers. “Over the last few weeks, we’ve seen a surge in entering leads, and for the first time requests from physical shops who now also want to go online and have even lesser capabilities to do the fulfillment in-house” shared Alexander, CEO of Byrd.

Public authorities have a role to play in the emergence of these alternative supply chains, allowing small retailers to remain independent of giant marketplaces. In France, Ma Ville Mon Shopping offers a viable alternative to Amazon for local shops, both in terms of marketplace and delivery service (operated by Stuart). The Loire-Atlantique Chamber of Commerce and Industry even deployed the solution free of charge in Nantes during quarantine.

2.3. A time of opportunity for warehouse automation solutions, but not for AVs all around

Given that volumes are not expected to decrease after quarantine and that managers will not be able to increase the density of workers within the warehouses, it is likely that there will be a wave of warehouse automation. Vincent, from iFollow, told us that they were currently working with a major parcel company operating in France to equip one of their hubs with robots by June. “They needed a short-term solution to keep their operations running with fewer people on site without having to freeze their entire supply chain.”

The question is whether other parts of the supply chain will become more autonomous. While JD.com deployed drones and autonomous robots in February and Neolix is currently using unmanned vehicles to supply hospitals in Wuhan with medical equipment, the use cases are mostly specific to hospitals. Even if AV players place a lot of hope in first and last mile delivery to become the growth engine of autonomous vehicles, one may wonder if logistics players will invest in such solutions in the midst of the economic crisis, especially since there is no necessary need outside of warehouses and it could be subject to regulatory controls.

2.4. Risk assessment as a new driver of supply chain decisions

For manufacturers with fast production cycles and lean supply chains — such as in the automotive sector, but also in electronics, semiconductors, chemicals, pharmaceuticals, consumer packaged goods, etc. — the penalty cost for not supplying even one hour can be huge. It therefore has become essential to be able to accurately forecast short-term evolutions so that operations can restart at the right time to meet demand. “It’s a question of choosing the right supplier, but also of managing the supply according to the forecasted demand and avoiding out-of-stocks situations. Increasing the buffers would be unbearable in terms of costs, which is why industrial companies will have to implement advanced optimization tools to have the right inventory on the right product” said Jean-Baptiste Clouard, CEO of Flowlity.

While the supply chain risk management market has entered its slope of enlightenment during quarantine, mainstream adoption is expected to take off when lockdown is lifted. Manufacturers will wonder how quickly recovery will occur and how reliable suppliers will be — which ones will fail unexpectedly? For weakened industrial players, choosing the right partners will become a matter of life and death. In addition to assessing the quality, price and availability of items, the risk of financial bottlenecks for suppliers will have to be assessed at an early stage in order to put appropriate countermeasures in place.

Phase 3: Period of recovery — Development and distribution of a vaccine at large-scale

3.1. The time to take stock of the damage for the least adaptable players

Today, the lagging large corporates are being hit hard by their reluctance to adopt ambitious transformation plans. “The freight forwarding market today is made up of 40% of medium and small players. Very few are digitized, and they probably had to face cash issues more quickly than the large players. We expect a strong concentration in the market in the coming years.” plans Brieuc, from Ovrsea.

In the manufacturing market, some upstream tier two and three suppliers — typically medium-sized companies operating with 2–3% margins and low cash reserves — will have to be acquired by their customers simply to keep the plants in operation. Many of them will also be at risk of bankruptcy, threatening the entire supply chain. In the retail market, the same is likely to happen for small and local shops.

This will contribute to the economic crisis that is already hitting the world. Cuts in R&D budgets will continue to be announced, while development roadmaps will probably focus on core products and geographical areas. Being able to scale back or adapt one’s business model will be a key skill to maintain profitability and even compete with less flexible players. “This period requires agile solutions that can provide fast returns on investment — and today, 95% of automation solutions are huge and customized automation systems, with ROI of up to 10 years. Business models will need to adapt, otherwise these large companies might see their pipe dry up in the next few years” explains Vincent from iFollow.

3.2. Supply chain diversification will be limited by the economic rationale

In the long term, manufacturers will be rethinking how they orchestrate their network of suppliers. The manufacturing of critical spare parts will either be relocated closer to the major manufacturing plants or manufactured in house (thanks to additive manufacturing for instance). “Our customers have experienced an accumulated risk due to a concentration of suppliers in China. In the long term they will try to diversify in different geographical areas. However, betting on a single supplier is sometimes motivated by economic reasons, and as we are now in a recession, I think that saving money will also be a priority,” expects Heiko from Riskmethods.

Amazon closing its warehouses to non-essential products during the quarantine phase triggered a wave of independence among its third-party sellers. Although many restaurants and retail shops are onboarded on giant marketplaces, these players may very well begin to question their dependence on intermediaries which capture a significant share of their margins after the crisis. “We are already seeing restaurants considering developing their own distribution channels. They are afraid of becoming too dependent on a single platform and losing not only their margin, but also the customer relationship and knowledge” shared Nicolas from Stuart.

For e-commerce, risk mitigation will involve not only sales channels and delivery partners, but also diversified warehousing sites to ensure continuous access to customers worldwide. “In recent weeks, we have been approached by major American consumer product brands that typically had only one warehouse in Europe. They are concerned that a resurgence of the virus in Autumn could deprive them of market access, so they are already looking to diversify their distribution network” shared Alexander from Byrd.

3.3. The period is full of opportunities for logistics startups to seize

Logistics and supply chain startups have been the most active during this crisis, especially during quarantine. If these players manage to adapt to the coming economic crisis, they could become key players in tomorrow’s value chain. But to do so, startups need to focus on cash management. As the gross margins of logistics startups are low compared to most industries, unpaid invoices could quickly turn into difficult liquidity positions. Building a healthy customer base and growing it more quickly (by offering freemium options or robot rental for instance) will be paramount to avoid bankruptcy. Value propositions might have to revolve around reducing costs rather than increasing revenue or quality of service. But with their easy “plug and play” solutions, which require little investment and change, logistics startups could well establish themselves in markets long dominated by traditional players. In short, crises are a good time for frugal innovation.

Above all, it is a time of opportunity to sustainably increase revenues while increasing margins. Already in recent years, players involved with the shipping and delivery of goods have been constantly raising their prices. With the increased pressure on logistics, this could further strengthen the trend. The diversification initiative by Meituan is a good example of how a vertical delivery player can increase both revenue and margin by expanding into more profitable market segments.

Conclusion

Supply chains are acting as a safety net for the entire economy. After lockdown is lifted, we expect the urban logistics players to retain the most customers, freight forwarders to strengthen their positions in the supply chain with the increase of freight rates, and risk management solutions to finally become mainstream, bringing the transparency and predictability needed for economic recovery.

In the long term, the exponential growth of e-commerce will increase the density of the world’s logistics network, which could be at the expense of the environment — international freight transport accounted for more than 7% of global emissions in 2010, not counting urban logistics.