To help our portfolio companies navigate through the current “fog of uncertainty”, we have decided to write a series of articles in which we’ll delve into the impact of the Covid-19 sanitary crisis on our areas of expertise: energy, mobility and industry 4.0.

In these articles, we will analyze the impact over three different periods identified in our first article:

- Quarantine period — Fighting through the sanitary crisis (10–15 weeks in the UE)

- Safe-mode period — Learning to co-exist with Covid-19 (after quarantine)

- Period of recovery — Development and distribution of a vaccine at large scale (from 2021)

Who would have thought that over 3.9 billion people worldwide could be confined in their homes and that most long-haul transport could be frozen? It’s undeniable, we are in the middle of a major health crisis that, depending on its outcome, could lead to the biggest economic crisis in our recent history.

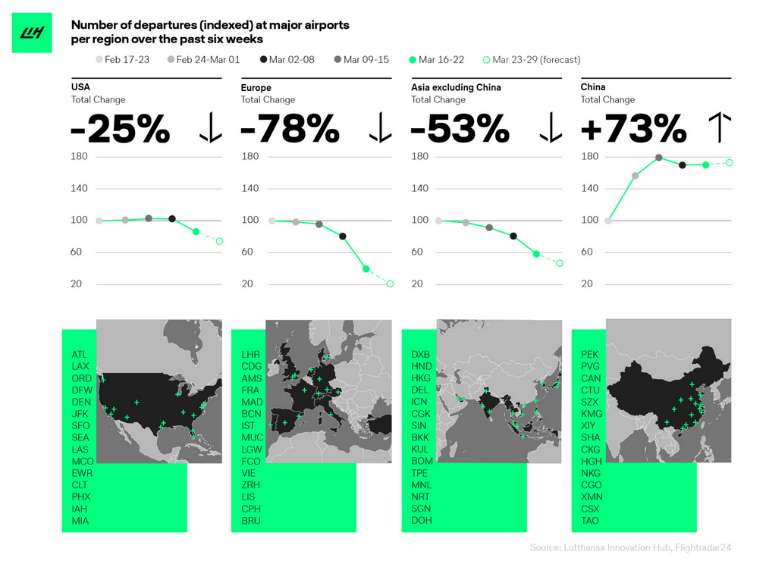

However, the travel industry is not at its first crisis. The 1990–1991 Gulf War reduced annual airline revenues by 25% (with the impact lasting almost a year) and the 9/11 terrorist attacks cut them by 20%. Yet, the Covid-19 lockdown is hitting the long-haul transportation industry 5 to 6 times harder than the latter. In just a few weeks, the world’s busiest airlines have grounded nearly all the planes in their fleet and seen their number of flight departures drop significantly (by 78% in Europe and 53% in Asia excluding China in only 6 weeks, see graph below).

Mobility being one of the sectors in which we invest here at Aster — we have notably invested in Swiftly, Karos, Wluper and EasyBike — we have decided to delve into the impact of Covid-19 on the future of long-haul transportation. In this article, we will focus on air travel, train and bus operators exclusively, excluding cars and ships from this analysis. The question is: will people still travel by plane, train, and bus when the “new normal” takes hold?

Phase 1: Quarantine period — Airlines, bus and train operators facing travel restrictions

The travel restrictions imposed by many countries has resulted in an unprecedented decline in global air traffic: over 90% of Lufthansa Group’s fleet (Europe’s largest air carrier) is grounded.

“In only one day, buses were nearly all grounded and train operators down to 7% of their usual volumes”, according to Matthieu Marquenet, CEO and cofounder of Kombo (a digital platform for booking multimodal bus and train trips). More generally, the entire travel ecosystem has been affected, from OEMs (Airbus, Alstom) and their suppliers (Safran, Thalès) to hotels (Accor Hotels) or travel retailers (Lagardère).

In these difficult times, many operators have been requisitioned to support the war economy by:

- Transporting patients with serious illnesses from overcrowded hospitals to other regions: in France, the SNCF (the national state-owned railway company) has evacuated dozens of people by last-minute medicalized trains.

- Supplying cities with food: Fret SNCF has mobilized 50 trains for cereal suppliers and farmers and has already transported over 65,000 tons of food supply.

- Transporting medical supplies: on March 29th, a first Air France cargo flew back from China with 5.5 million medical masks and over 100 tons of medical supplies. Dozens of other flights have been chartered to bring back around 600 million masks and ventilators over the next 14 weeks.

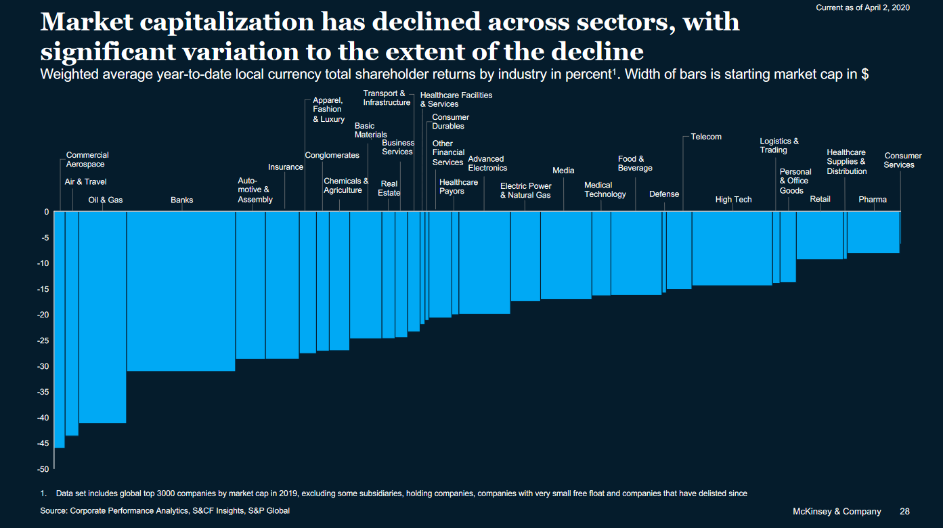

Commercial Aerospace and Air & Travel are the two industries experiencing the largest market capitalization declines.

Transport operators will suffer from a massive drop in revenue in 2020 due to quarantine with a decline in holiday bookings and a rise in cancellations and passenger refunds. Revenues will also be impacted in 2021, as most operators have issued vouchers to manage short-term liquidity, which will lead to long-term liquidity disruptions. Tier 2/3 operators will especially be impacted by the cash flow uncertainty, as most do not have more than a 3-month working capital level.

In response, operators have taken urgent actions to cut operating expenses and improve balance sheet resilience. The operators most at risk are those that were already vulnerable to shocks (like Flybe for the airlines), not-so-profitable or had weak balance sheets.

Phase 2: Travelling while coexisting with Covid-19

Even once lockdown and travel restrictions are lifted, the industry will suffer massively from the fear of a second pandemic peak. A very influential paper from Imperial College London speculates that governments will need to turn lockdown measures on and off in order to keep demands on healthcare systems at a manageable level. Having just reopened its borders, Singapore is already suffering a second pandemic peak.

According to the World Economic Forum, the contraction in airline revenues due to trip cancellations and country-specific restrictions could cost the industry at least $880 billion. Several sources agree that international traffic will not return to pre-crisis levels before 2022.

During Phase 2, we will see even more Tier 2 and Tier 3 players go bust and many acquisitions or recapitalizations flourish. States will most likely have to intervene to support Tier 1 operators such as Air France. In the US, the Congress has already launched a $50 billion rescue package for American airlines. Not to mention the weaker players, the startups seeking to raise funds or join forces with large players, for whom it will be even more difficult to cope with the liquidity crisis. Beyond the liquidity issues, operators will have to make safety measures their number one priority. While the outlook seems very bleak, this crisis will also be an opportunity for some to stand out in a new competitive landscape and develop new travel products.

An interesting way of looking at Phase 2 is to look at how China is recovering. After quarantine, business travel resumed for small gatherings as well as domestic tourism. Hotels have returned to 30% of their pre-crisis levels (up from 7.4% in the first week of February) and air travel to 42%. However in Europe, 73% of travel companies surveyed by Roland Berger project that holiday budgets will be lower this year and 99% that French people will stay in their home country this summer. The industry will pick up again, but competition will be fierce: Ryanair has already announced that they will be lowering their prices to beat their competitors.

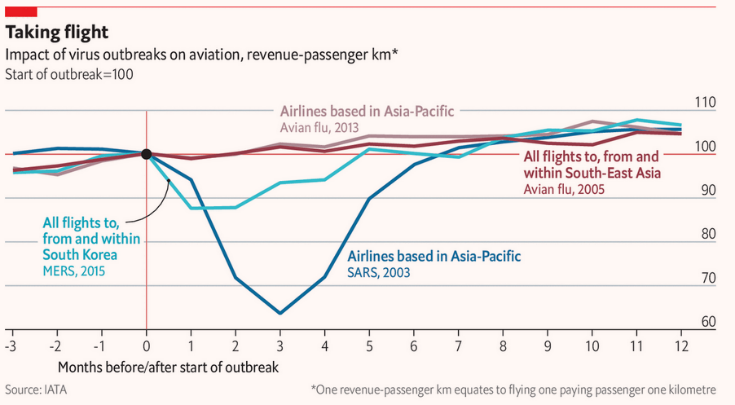

In the past, it took 6 months for air travel to reach pre-crisis levels after the SRAS outbreak in 2003 (see graph above), but this crisis will certainly last longer. In Phase 2, business travel will be limited, due to the cancellation of major events and conferences, and remain more local, thus boosting short-haul trips.

Phase 3: Sanitized and responsible travel will be the new normal

In this new reality, we will witness a dramatic restructuring of the long-haul transportation industry. From our conversations with our startups and some industry leaders, this is what the “New normal” could entail:

1. Why travel when you can do everything remotely?

The Covid-19 crisis will accelerate many trends going forward, especially the growing concern for climate change. After travel restrictions are lifted, we will probably see many people opting not to travel, motivated by guilt and concern for the environment — especially as companies have discovered the practicality of flexible working and remote conferencing. However, this will probably only be true in Europe: in Asia, most of the air traffic growth is projected to take place over the next 20 years, while in the US there is no real alternative to air travel.

The tools used by remote teams to stay connected (Zoom, Slack, Teams, Asana, Dropbox, Instagantt, etc.) will increasingly be used for other activities than work while long-distance travels will be replaced by options such as online museum visits (with Boulevard), VR travel (with Google Earth VR) or even virtual diving (with theBlu).

2. Travelling? Yes, but what about the planet?

This crisis will trigger a new wave of investment in the sustainable travel industry, namely in:

- High speed rail: climate change awareness will most likely lead to a shift from air travel to rail, with 4-hour high-speed train journeys replacing short-haul flights. Matthieu Marquenet from Kombo predicts that “after the crisis, train and bus trips will explode compared to planes, also because of the liberalization of European rail end of 2020 that will drive prices down”. To surf on this trend, they have just launched Komb’Home, a new app that rewards people for staying at home with post-crisis travel discounts. Alstom, one of our corporate sponsors, is investing heavily in this sense: sustainable rail, network electrification and hydrogen trains. According to the European Commission, 2021 should be “the European Year of Rail” and the industry should reach €11bn by 2022.

- Greener aviation: the aviation industry will move towards a greener future by investing more in green synthetic fuels, liquid hydrogen, energy efficiency, route optimization and electric aviation (EVTOL and ultra-light power density batteries). In the medium term, this green pressure will jeopardize aerospace suppliers and their aftermarket revenues by forcing airlines to replace their current aircrafts with greener ones.

3. Will travel experiences ever be the same?

Just as 9/11 changed security checks, Covid-19 will likely permanently change the way we travel.

- Focus on safety and health: we will probably have to wear a mask, carry an immunity passport and undergo a health check. In France, the SNCF has already announced that they will reinforce their cleaning services and offering hydroalcoholic gel on trains. Jean-Pierre Farandou, CEO of SNCF, believes that “wearing a mask should be mandatory. It’s the only option for trains, and even for all [urban] public transportation”. According to Nabih El Aroussi, CEO at Moove Tech and ex-founder of Traveldoo (Expedia), “corporates are realizing that business travel is not just about getting from point A to point B quickly, but also about ensuring safety”. “Moove Tech already offers features to track and assess the sanitary safety and environmental footprint of employees’ travel.”

- A soaring demand for travel insurance: Fearing the resurgence of a virus, people will be more willing to pay for cancellation insurance fees and book through travel agencies.

- Domestic travel will be back: Many more people are expected to steer clear of complicated international travel and instead explore their own countries.

- All-inclusive resorts will undergo a serious overhaul: Social interaction and physical mingling are inherent pieces of the all-inclusive holiday experience. We therefore expect people to opt for more “premium” and intimate travel experiences (e.g. with PerfectStay), choosing private rooms rather than hostels, or for the wealthy, private jets rather than crowded flights. Jean-Pierre Farandou also mentioned that “if the winner of this crisis is the individual car, it would be a disaster”.

4. Optimizing operations to stay alive?

The crisis outbreak will force long-haul transportation companies to rethink their operations. Railway operators will invest in digitization to improve productivity, optimize asset management (through predictive management) and enhance their passengers’ experiences. As for airlines, they will certainly invest in tools enabling them to increase productivity (some startups are already specialized in airport operations such as Airport Labs, Adveez, Assaia or Innovatm) and enhance passenger experience (travel booking experience with Mindsay or check-in fluidity with Passnfly). According to Anthoine Dusselier, CEO at Tarmac Technologies — a startup optimizing aircraft ground operations — “today, there is room for improvement in the way airlines manage their ground operations, and we believe it will become more critical than ever in the coming months”. Tarmac is helping major airlines streamline their ground operations and reduce delays, enabling them to cut costs and increase customer satisfaction, hence revenues.

Conclusion

What is certain in this uncertain world, is that in the long term, people will continue to move. Maybe we will travel less, maybe we will travel differently, but we will not stay confined forever.

Like all crises, the Covid-19 health crisis will trigger creative destruction and innovation: remote working will be definitively established, distance partying/networking/gathering will become fashionable, long-haul transport will be reduced, electric vehicles will fly, fuel will be more environmentally friendly, hydrogen trains will be on rails and health safety will be part of the new travel experience.