To help our portfolio companies navigate through the current “fog of uncertainty”, we have decided to write a series of articles in which we’ll delve into the impact of the Covid-19 sanitary crisis on our areas of expertise: energy, mobility and industry 4.0.

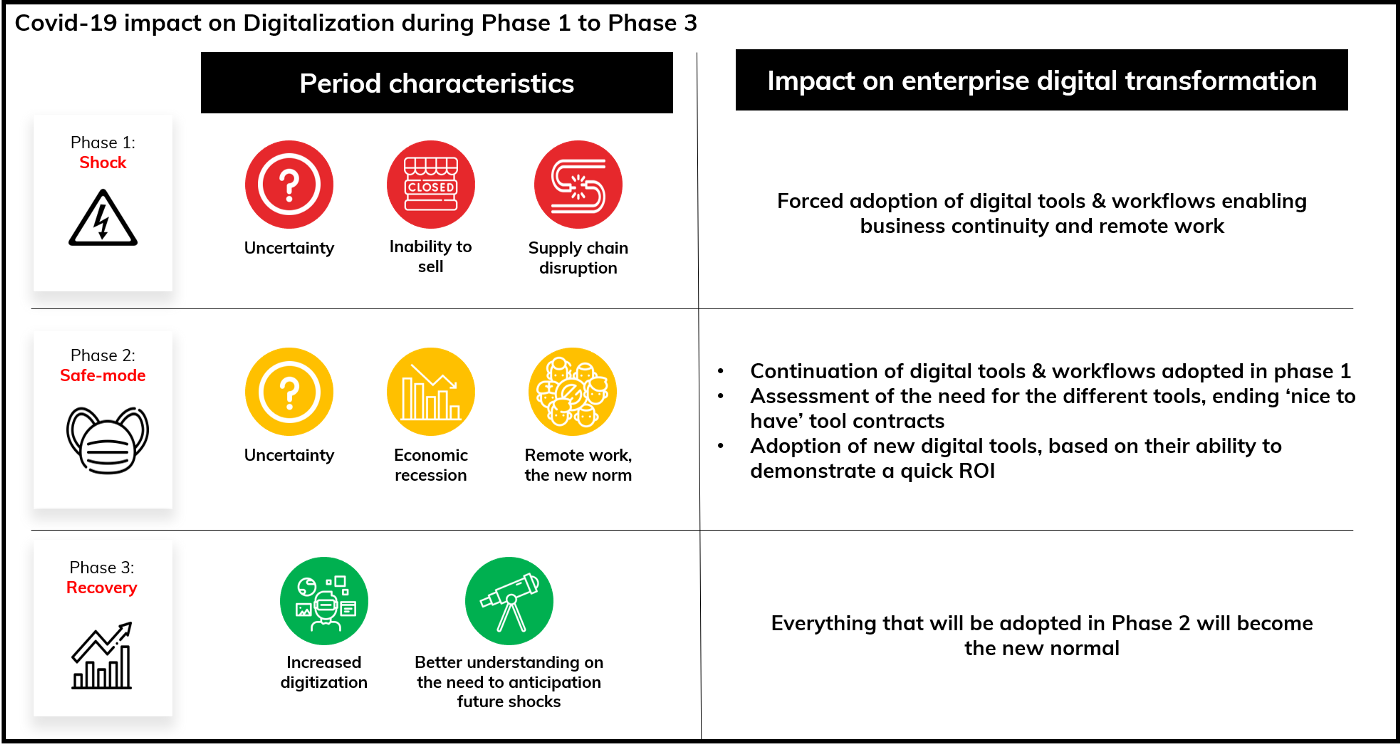

In these articles, we will analyze the impact over three different periods identified in our first article:

- Quarantine period — Fighting through the sanitary crisis (10–15 weeks in the UE)

- Safe-mode period — Learning to co-exist with Covid-19 (after quarantine)

- Period of recovery — Development and distribution of a vaccine at large scale (from 2021)

Introduction

In just a few months, the coronavirus outbreak has triggered a global sanitary crisis and is expected to have a lasting impact on the entire organization of our societies.

But let’s rewind a bit: it is 2019, most of the world’s economies are still growing, the Dow Jones is reaching an all-time high and global VC activity is projected to reach $295bn (its second best year ever after the record $322bn for 2018). Digital transformation is one of the key macroeconomic trends that investors like us are watching, as we believe that corporates and individuals will increasingly benefit from digital productivity tools in the coming years.

Fast forward to today. Many organizations have either partially or completely closed their offices and have hastily reorganized to cope with the crisis. But what role have digital tools had in this reorganization? What impact will coronavirus have on organizations’ digital transformation efforts?

Phase 1: The forced march to run business operations remotely

The Covid-19 outbreak has put a large number of organizations in a state of shock, defined by:

- Uncertainty: the inability to anticipate what will happen next — will customers stick around? Will there be enough cash at the end of the month? — which is the worst thing that can happen to a business

- Inability to sell: a lower demand for both B2B and B2C companies due to the lockdown restrictions

- Supply chain disruption: the inability to purchase materials/parts/inputs as before — especially for those dependent on China — leading to slowdowns and shutdowns.

Companies have therefore gone into ‘emergency mode’ to keep their operations afloat while managing their cash efficiently.

According to our discussions with our network, those who have best dealt with the situation are the most digitized players: startups and large players who had already migrated to the cloud, implemented remote work policies or could run business 100% remotely. Conversely, the most affected by the crisis are those for whom remote meetings are not really feasible, distribution channels are purely physical, change management is complicated or IT systems and processes are outdated and complex. Among the latter are mainly industrial players, who have been forced to shape digital transformation frameworks in a matter of weeks instead of years.

In short, Covid-19 has dramatically accelerated digitization for many companies — the number of daily Zoom sessions has skyrocketed from 10 million in December 2019 to 300 million in April 2020. It is estimated that before the pandemic, only 7% of US workers had access to a ‘flexible workspace’ benefit, or telework, according to Pew Research Center. Today, 42% of workers who did not work from home are doing so, according to CNBC’s All-America Economic Survey.

But don’t be misled by these figures, this forced transition has mainly consisted of (1) subscribing to video conferencing apps (2) massively deploying VPNs (3) moving to the cloud. In a word, this is more a matter of putting a digital band-aid on a wooden leg than a structural change in the way decisions are made. While these changes have had a huge impact on the way corporates organize themselves and the way they perceive remote work, they are only a trigger for a larger wave of digital transformation to come.

Phase 2: Avoiding the workplace as much as possible, unless there are no other options

Western economies are now looking at deconfinement and thinking carefully about how people are going to move around. For businesses, this phase will be long (at least 18 months), uncertain, and will have a lasting impact on corporate roadmaps and organizations. In concrete terms, it is likely that most corporates will face:

- Uncertainty: the level of uncertainty as to what will happen next will remain high

- Economic recession: consumer behavior (B2C & B2B) and purchasing power will change, causing a global economic recession

- Remote work will be the new norm: for most organizations, remote work will become the norm as it is the simplest solution to ensure the daily well-being of employees

As a result, it is likely that enterprise roadmaps and digital customer experiences will be impacted in the next 18 months, with 2 main consequences:

1. The impending economic crisis will reduce overall corporate spending and the risk of adversity.

We expect managers and business leaders to have limited budgets and not be willing to engage in new/uncertain innovative projects that will not be considered essential for recovery in phase 2.

While ServiceNow’s CEO estimates that $7 trillion could be spent on digital transformation by 2023, it is likely that decision making will more than ever be driven by rapid and measurable ROIs. While this has always been seen as an implicit requirement, we believe it will become more explicit for decision makers: corporate digitization will have to focus on productivity gains and serve their economic recovery.

Overall, this means that startups and software vendors that are able to quickly demonstrate clear value will be strengthened while others, perceived as ‘nice to have’, will be weakened. For the ‘winners’, sales cycles and adoption may even be faster than before.

Concretely, this doctrine will have an impact on the type of digital tools adopted by corporates with:

- The rise of new communication tools connecting frontline workers (blue collar workers, salespeople, etc.) to other stakeholders (managers, customers)

- The rise of vertical solutions allowing obvious productivity gains for essential functions (e.g. robotics in industry/logistics)

- The rise of horizontal software for organizational efficiency (RPA, AI tools replacing low added-value tasks)

- The increase in capital and operating expenses for both IT infrastructures (move to the cloud) and physical infrastructures (local outsourcing, 3D printing, etc.).

2. The efforts made by organizations in Phase 1 to run remote operations will continue and remote work will become the new norm.

Now that many organizations have discovered that remote work actually works, Phase 2 will be more about ‘how to adapt the organization to operate remotely?’ than on ‘is it possible for my organization to work remotely?’. As a result, we can expect a perpetuation of the digital tools that enable remote work and digital communication for most of categories of workers.

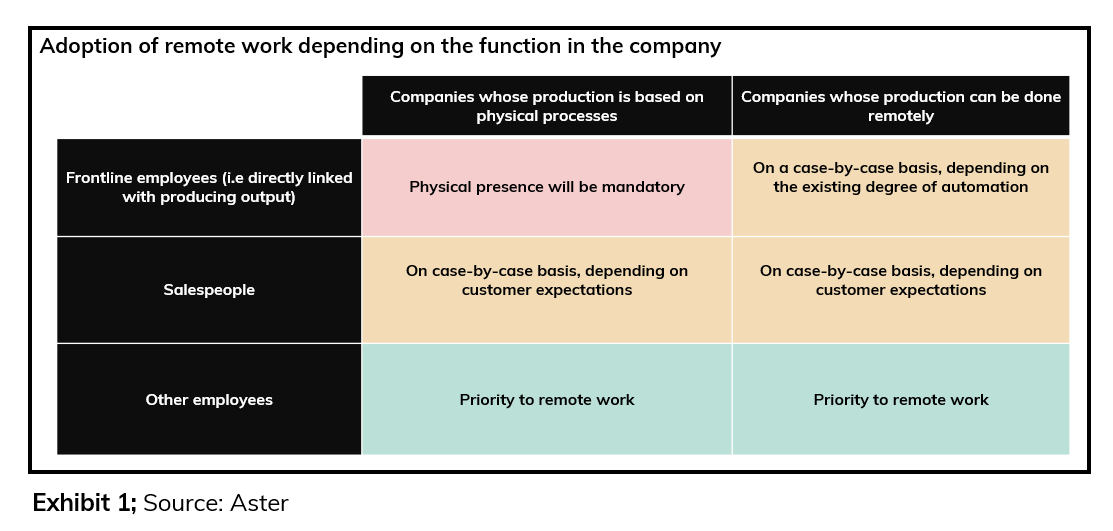

Again, this will obviously be easier for companies where the physical presence of employees is not mandatory for business continuity. Specifically:

- Red: for workers whose daily job involves non-substitutable equipment (industry, logistics, retail), physical presence will be mandatory and strict health and safety measures will have to be taken. These workers will continue to demonstrate that they are essential in many organizations and are likely be recognized as such.

- Orange: for workers whose daily job involves interaction with people who either (1) are not equipped with digital tools (e.g white collar -> blue collar interactions on industrial sites) or (2) perceive face to face meetings as something mandatory (e.g b2b business developers), it will be more of a case-by-case situation. In general, we can expect a greater adoption of digital solutions to move from face to face to digital meetings.

- Green: for workers whose daily job can be done 100% remotely (service industry, support functions…), there will be no clear incentive to return to the workplace — it would be more a question of resuming old habits than a necessity. Moreover, it is likely that a large majority will consider this to be unsafe or dangerous.

Phase 3: Increased agility & versatility towards running businesses 100% digitally

Hopefully in a few years a vaccine will have been found to protect the world’s population against Covid-19. By then, Phase 2 will have lasted months, if not years, and individuals and organizations will have learnt to work remotely and adapt quickly to sudden shocks.

Organizations will still have antibodies from the Covid-19 period and will not forget that resilience is an acquired trait rather than an innate one. They will have experienced digital changes at a fast pace and will be better able to assess the digital tools they need to become more agile and achieve real productivity gains quickly.

The benefits achieved in Phases 1 and 2 are expected to continue in Phase 3, mainly because digital transformation is mostly about UX, and UX is mostly about comfort for both users (ease of use, increased individual productivity) and organizations (increased collective productivity).

Conclusion

Digital transformation was already taking place at fast pace. Now, it seems to be a matter of life or death for organizations. The transition to digital and more fluid processes is accelerating for the greater good. It will more than ever make a difference between organizations that can anticipate and surf the waves of the future, and those that will drown under in the ocean of corporate rigidity. For startups, designing the most efficient surfboard and supporting customers will be a matter of survival. Let’s ride!