Towards a greener future?

As all projects for 2021 are being planned today, not all construction projects will go ahead as planned when the recession hits.

1. Towards a decrease in investment because of pressure on public and private budgets?

The government and policy-makers’ reactions to such a pandemic are hard to forecast. Whilst some countries may show resistance to change and slow the shift towards renewable energies, other countries may demonstrate an aggressive approach to accelerate the transition. Ultimately, the pace of the recovery and shift will depend on how governments direct their economic recovery spending.

Some countries like Spain have announced that Feed-in-Tariffs (FiT) would be extended, others have created new ones to boost the demand for renewable energy (e.g. the United Kingdom has announced new FiTs to boost the solar industry), whilst in some countries like the United States FiTs are fading.

Many argue that including incentives for renewable projects (tax credits, investment grants, loan schemes, etc.) should be a top priority in upcoming stimulus packages. In the EU, the €1 trillion Green Deal climate package, crafted before the COVID-19 outbreak, is now being touted as a critical part of economic recovery. Yet, one wonders whether climate commitments will take a backseat in economic recovery plans with investments in clean technologies being either abandoned or scaled down.

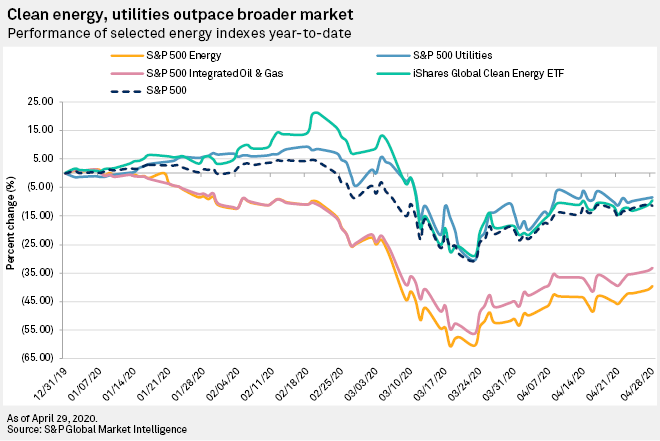

One thing is for sure: climate change and other environmental, social and governance (ESG) issues are being increasingly recognized as key determinants of a company’s future value creation potential. And renewable energy is demonstrating higher ROI than fossil fuels. According to a recent study carried out by Imperial College London and the International Energy Agency clean power stocks generated higher returns over the past 10 years, five years and this year — in the UK clean power companies such as John Laing and Ceres Powers have outperformed peers such as BP and Tullow over the past five years.

2. Will the lower oil prices affect renewable energy penetration?

Government policies have been forcing utilities to retire coal-fired power plants — since 2010, the net loss of coal capacity in the US has fallen by 102,000 megawatts. Yet, the recent decline in oil prices could lead countries whose economies are built on fossil economies to see a transition to cleaner energy as unnecessary.

In fact, the UK-based think tank InfluencyMap recently carried out an analysis on the corporates lobbying in the face of the Covid-19. It found that, large oil and gas players have been the most active in seeking for direct and indirect support (stimulus funds, pollution regulations and the use of the strategic petroleum reserve to bolster prices). As reported by Emily Holden for the Guardian beginning of May, records show that fossil fuel companies have already obtained $50 million in loans.

But despite the stimulus money and the weaker pollution regulations, the oil and gas industry is more vulnerable than ever. “The pandemic exposes and exacerbates fundamental weaknesses throughout the sector that both predate the current crisis and will outlast it” stated the Center for International Environmental Law (CIEL). Long before the crash in prices, the oil and gas industry has been projected to peak as external pressure has surfed — not only from environmental activists and regulators, but also from central banks and hedge funds — for the oil industry to diversify into lower-carbon energies.

In short, fossil energy may be cheaper now, but fossil fuel projects are becoming even riskier. With the increasing carbon-conscious investing and the worries that many fossil projects may become unviable, the lower prices are not an immediate threat to renewable energy. An indication: despite an oil price crash in 2014–2015, the renewable energy investment had a historic run.

3. The rise of a new momentum?

As said previously, without government action, this crisis could considerably disrupt the momentum around renewable energy. Conversely, with government support and carbon-consciousness, it could well be the start of a new momentum.

In fact, in Australia experts advocate that renewable energy may well drive economic recovery. According to Kane Thornton, CEO of the Clean Energy Council in Australia, “there is still a strong pipeline of renewable energy and storage projects and enormous customer demand for rooftop solar and batteries. These will be critical in replacing Australia’s aging coal-fired power stations, meeting Australia’s climate change targets and ensuring affordable and reliable power supply.”

With Covid-19, renewable energy has also gained new momentum in some countries and sectors. The transition to renewable energy has been slow in the mining industry yet even the remotest mines in Africa are now starting to consider solar, wind and energy storage. According to Alastair Gerrard, CEO of Zest WEG Group Africa, which supplies a wide range of electric motors, “the last year or two has seen a significant uptake in interest and securement of renewable energy power projects in the mining industry — which on a positive note is occurring across the African continent and not only in first world territories.”

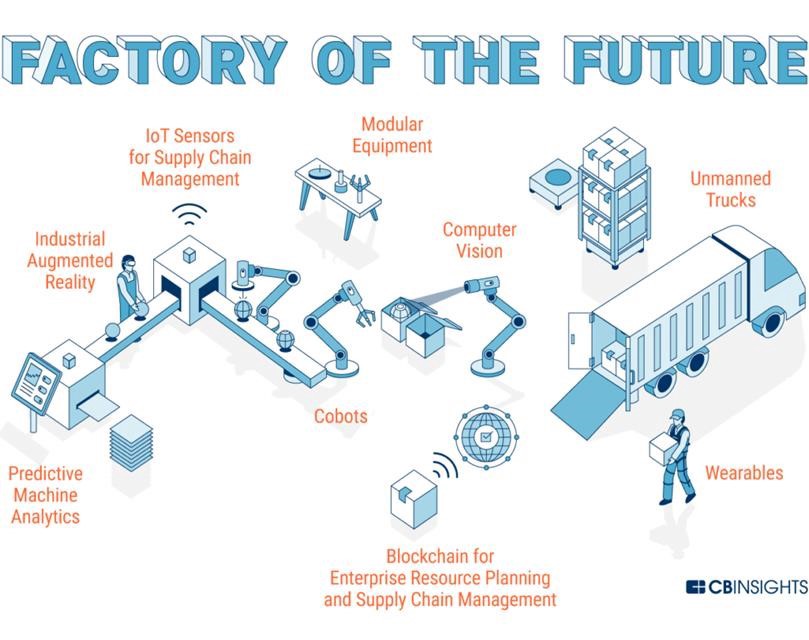

Finally, technologies may well emerge from this crisis such as floating offshore wind farms, marine technologies and low-carbon hydrogen production. Recently Australia set aside $300 million to jumpstart hydrogen projects, the Netherlands unveiled a hydrogen strategy in late March for 500 megawatts of green electrolyser capacity by 2025 and a German hydrogen strategy is expected soon.

According to Antoine Huart, President of France Territoire Solaire, solar energy would be the energy pillar of resilience in the post New World — “produced by automated, digitalized, decentralized and abundant installations located in areas as close as possible to needs, solar energy seems to have been invented to meet the challenge of resilience.” Just as Europe has relocated lithium-ion battery manufacturing, it is questionable whether Europe will relocate solar manufacturing, since China accounts for 70% the world’s solar supply.