On average, four private companies valued more than one billion dollars were born per year in the 2000’s. By 2012, there were about thirty such “unicorns”, a term first used by Aileen Lee of Cowboy Ventures, a seed-stage venture fund. Today, Crunchbase lists 261 members of the unicorn club, including 49 which were added in 2016. The number of unicorns is skyrocketing due to the current market conditions and because investors believe that these businesses are going to change the world and, above all, provide them with a large ROI.

After combining data from three different databases[1], and excluding individuals such as Angels, we identified 298 companies from diverse types that have bet on, at least, one unicorn company, three fourth of them having been founded after the 1990s. Unsurprisingly, Private Equity funds (which include both Venture Capital funds and Private Equity funds) represented the largest group, and accounted for 65% of all unicorn investors. Corporate Venture Capital funds came in second at 17% and were followed by banks, insurance companies, governments, incubators, pension funds, angels’ groups, and others. The “unicorn hunter” with the most unicorns in its portfolio was the US-based Tiger Global Management, which held stakes in more than 30 unicorns.

Who are the originators of this new phenomenon? What is the profile of the investors who have contributed to establish these “super-companies” which, for most of them, do not make any dollar of profit?

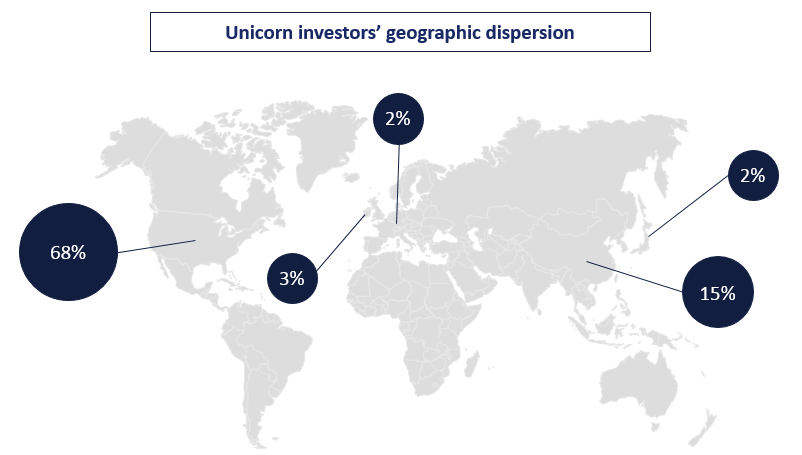

Geography

More than half of unicorns are based in the United States and more than a quarter of them are in China. The geographic dispersion of investors is relatively similar: two thirds of the investors referenced above are headquartered in the US, followed by China and Hong-Kong (15%), the United Kingdom (3.4%), Germany and Japan (2.0% and 1.7%, respectively).

The significant share of the United States in this ranking can be explained by the history of Venture Capital. Contrary to Europe and Asia, the US did not suffer from massive destruction during World War II: considered as the big winner, the US came out strengthened of the conflict. The unemployment dropped and the country got out of the Great Depression, while the rise of prestigious universities like the MIT, Stanford or Harvard was combined with enormous defense-related government spending during the Cold War to foster the development of innovative projects that required considerable amount of financing.

It was a Harvard professor, Georges Doriot, who created in 1946 the first investment fund to invest in young and risky companies: the American Research and Development Corporation. This marked the birth of the Venture Capital market in the US, and it was nearly 30 years later that the VC industry began to develop in Europe during the 70’s. Around the same time, the creation of the NASDAQ in 1971 created another new mechanism for American technology companies to raise large amounts of capital, which further emphasized the domination of the US in the field of new technologies.

Within the US, two states distinguish themselves: California is first-ranked with 45% of the US investors followed by the state of New York which represents 21% of American unicorn investors. Silicon Valley alone, and notably San Francisco, gathers five of the ten best unicorn hunters.

Role

The financing rounds required to support Unicorns are often extremely large, often in hundreds of millions of dollars if not a billion or more dollars. There are very few investors that can write checks of that size on their own, so the sheer size of these rounds often requires a large number of investors to participate. In most cases, there is only one lead investor for a given round, although there are some cases in which 2–3 investors co-lead a round. Regardless, the number of “follow-on” investors involved in a given round is often much higher than the number of lead investors. The average number of financing rounds led by an individual Unicorn investor is less than 1 out of 3 of all the deals that they’ve invested in.

In addition, there is a low correlation between the frequency of investment (i.e. the number of deals closed by year) and the number of invested unicorns: being an “active” investor does not seem enough to catch the stars!

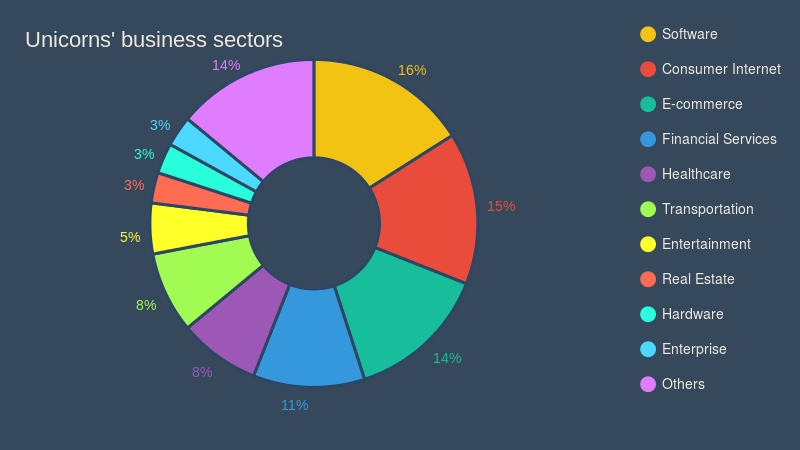

Sector

The average number of unicorns a given investor is likely to support is lower for industry-focused investors, or other funds with narrow investment focuses, than for general-purpose investors. In fact, three fourths of the unicorn investors have a general-purpose investment strategy. However, most of the unicorns have emerged from a limited number of sectors, namely software and consumer internet, followed by e-commerce, financial services, healthcare and transportation.

To conclude, maximizing your chances to bet on unicorns means to:

- Be a Private Equity fund with a focus on investing in venture-stage companies

- Have been founded after 1990

- Be based in California

- Be a follower, or “passive”, investor

- Have a general-purpose investment strategy

- Invest mostly in USA and China.

[1] Crunchbase, CB Insights and Thomson One Banker