Driven by the low cost of solar PV and lowering cost of energy storage, Energy Communities are on the rise. Energy Communities cover aspects of collective action to reduce, purchase, manage and generate energy. As members of a community, consumers can share their self-produced energy with other members of the community. Doing so, consumers can achieve significant savings. Energy Communities involve major changes in the way the Energy value-chain is structured, and will push traditional players such as energy retailers and DSOs (Distribution System Operators) towards deep transformation.

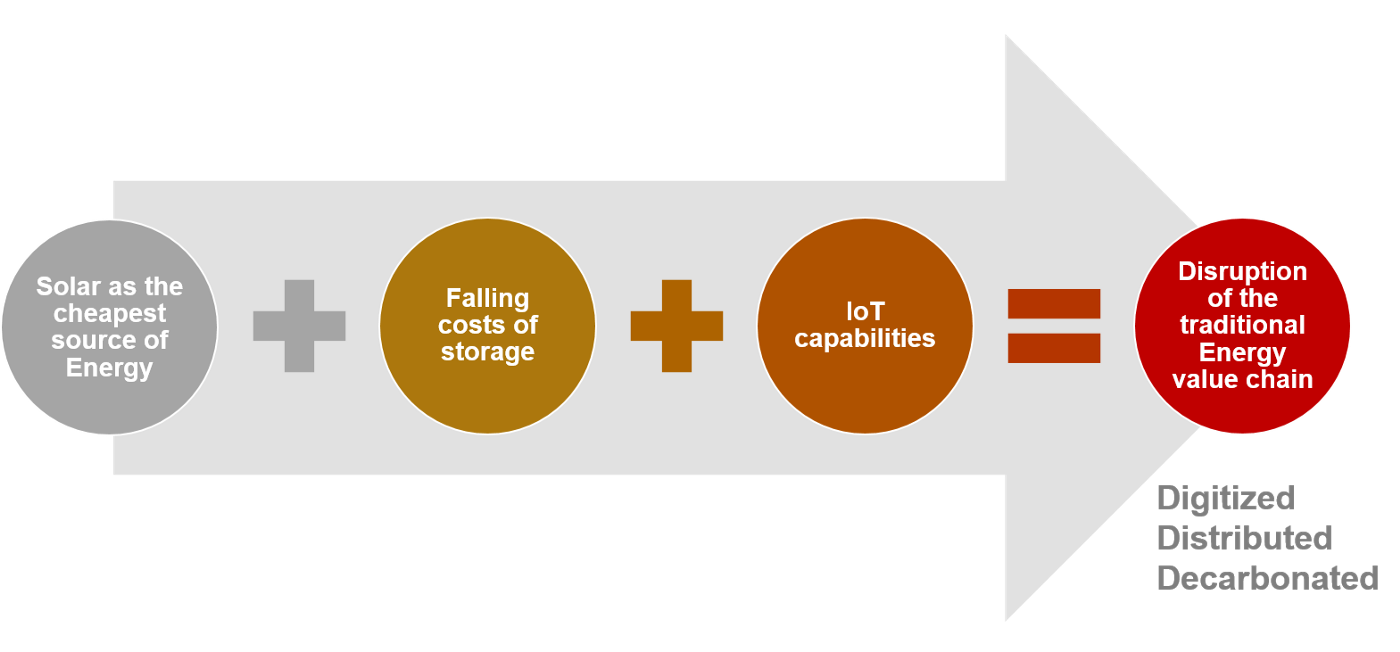

Solar photovoltaic (PV) will soon be the cheapest source of electricity: the average cost of solar PV fell by 61% between 2009 and 2015. Utility-scale solar installations cost today less than $1 per watt, and solar PV LCOE (Levelized Cost of Energy) is soon expected to range between €0.02–0.04/kWh, depending on geographies[1;2]. Residential PV installations cost today less than $3, with huge productivity gains to be expected in the upcoming years.

The PV hardware cost reduction was achieved through sheer scaling of PV production infrastructure. The same revolution is now coming to energy storage, as we see huge investments worldwide in battery facilities. Energy storage cost dropped from more than $500/kW.h in 2013 to ~$200/kW.h today, and is expected to reach less than $100/kW.h in 5 to 10 years[3]. This creates room for new applications and business cases, as the Levelized Cost of Storage is better understood and compared to use-cases and their economics[4].

Last but not least, technological barriers to the Internet of Things (IoT) have dramatically been lowered: smaller, more powerful and affordable hardware, connectivity enablers and supporting tools such as big data frameworks and cloud-based infrastructure are now ubiquitous. This creates new opportunities for disruption, i.e. new drivers for transformations of a century-old industry: the Energy value chain.

Energy Communities

As a result of the low-cost of Distributed Energy Resources (DERs), Energy Communities are being set up of multiple types. They can be local with physical boundaries[5], or virtual with a larger geographical scope[6]. Energy Communities cover aspects of collective action to reduce, purchase, manage and generate energy. As members of a community, consumers can share their self-produced energy with other members of the community. Doing so, consumers can achieve significant savings. This is the main value proposition of Energy Communities and the main driver for change from customers point of view, although other drivers exist such as access to clean energy, social impact, independence from traditional utilities, etc.

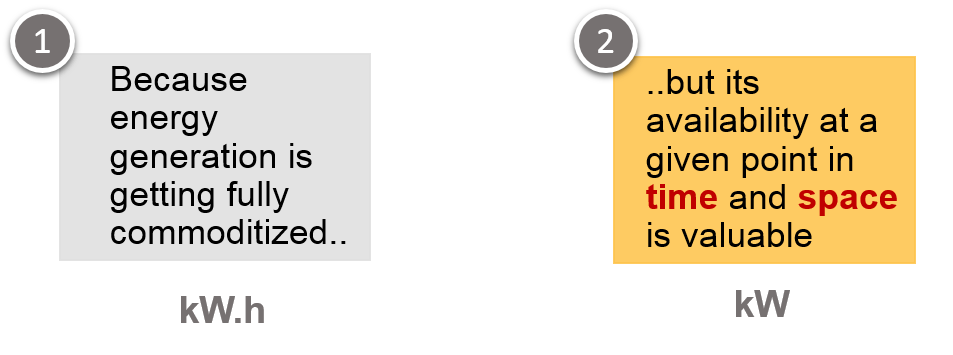

In a nutshell: Energy is moving from a commodity value to an exchange value. Because of locally distributed resources (in space), and their varying availability (in time), consumers can leverage the community to make the most of DERs.

Multiple innovative players position themselves as actors of this transformation, with different strategic positions: end-customer solutions turned communities (e.g. Sonnen, Lumenaza), utilities solutions providers (e.g.Smarter Grid Solutions, Opus One Solutions), microgrid (e.g. Advanced Microgrid Solutions), or transactive energy players (e.g. Powerpeers, LO3 Energy, TransactiveGrid).

Impact on the Energy value chain

The above-mentioned players are inventing new models for generating and capturing value in the Energy value chain, selling smart DERs, community-based energy services, peer-to-peer energy trading platforms, etc.

This has a profound impact on the Energy value chain.

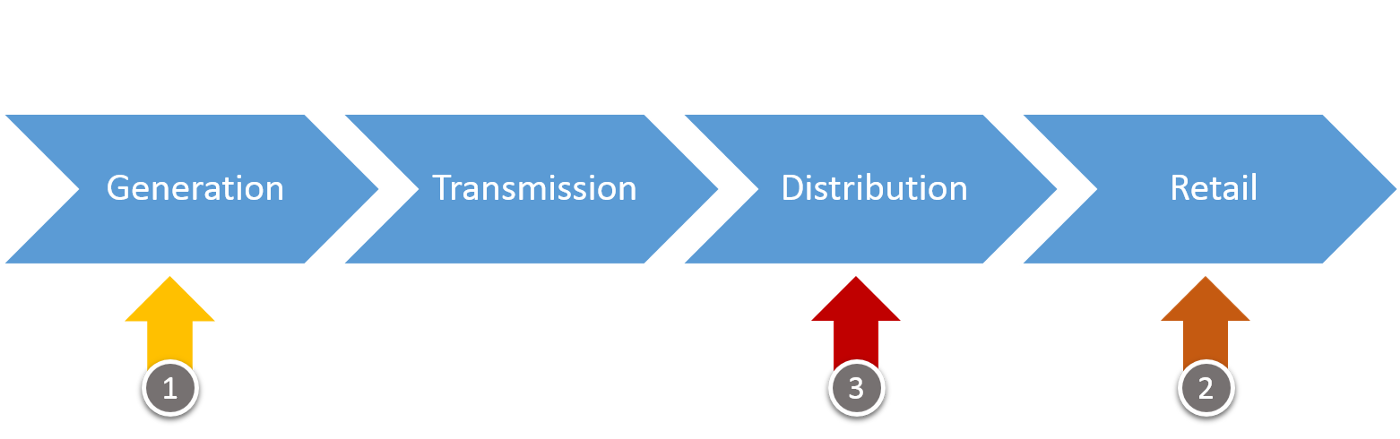

Distributed generation, mostly distributed solar, has already massively impacted generation-focused utilities (1). Increased self-consumption and community-based energy exchange now decrease revenues for both energy retailers (2) & DSOs (Distribution System Operators) (3).

But Energy Communities are also an incredible opportunity for established players. For retailers, Energy Communities are a great way to re-engage with their customers, by making customers become participative customers. For DSOs, local DERs can become a flexibility resource for active network management, thus reduction network CAPEX and OPEX costs. By doing so, retailers and DSOs can become enablers of change, reaping its benefits. In short, utilities need to embrace change, and do so rapidly. Indeed, because of network effects driven by Energy Communities, there will be in a not-so-distant-future strong first-mover advantages to offer energy & energy services.

[1] http://cleantechies.com/2016/09/20/jinkosolar-marubeni-score-lowest-ever-solar-pv-at-us%C2%A22-42kwh-in-abu-dhabi/

[2] https://www.pv-magazine.com/2016/12/28/danish-solar-auction-delivers-european-low-cost-of-us-1-81-centskwh/

[3] https://www.bcgperspectives.com/content/articles/energy-environment-how-batteries-and-solar-power-are-disrupting-electricity-markets/?chapter=2#chapter2

[4] https://www.lazard.com/media/438042/lazard-levelized-cost-of-storage-v20.pdf

[5] http://brooklynmicrogrid.com/

[6] https://www.sonnenbatterie.de/en/sonnenCommunity

“Silicon Valley wants more water start-ups” highlights a recent CNNMoney interview. Indeed, the number of water start-ups is considerably increasing -with the majority coming from North America, Europe and Israel-, introducing both breakthrough and incremental technologies that will undoubtedly disrupt the way water resources and services are managed.

Technology-wise, the two main sectors which have seen the most innovation are industrial water and wastewater treatment — with technologies that can save CAPEX and OPEX, in particular energy costs — and the introduction of digital technologies and services for water infrastructure and water quality management. The third one to watch is desalination. Higher performance membranes and alternatives to reverse osmosis are in development and will soon be commercialized at scale. These shall give a different perspective to this resource !

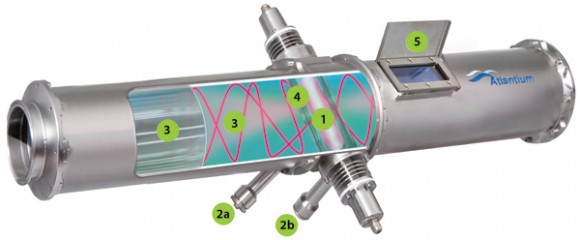

An example of a product by the Atlantium Technologies company, which aims to provide industry and municipalities with safe and sustainable water treatment solutions. The company has designed an innovative solution based on UV (ultra violet) disinfection, fiber-optics and hydraulics. It takes water safety to levels never before achieved with other UV systems or without chemicals. Aster first invested in 2013.

Start-ups range from early stage companies to research projects that can bring a real breakthrough in the sector and respond to an identified market need. It is important to create a long-term connection, be proactive and relevant in a sector which has historically been slow to embrace innovation. It is equally critical to acknowledge that in 90% of the cases, the technology is innovative, and the challenge is rather to bring a new economic and business model that will make the case profitable in the short-run. Partnering with incumbent companies can notably be a pre-requisite, but not exclusively.

Disruptions will be in technologies AND in the business models

Innovative technologies brought to the market by the start-ups will definitively disrupt the economic and business models applied in the water and wastewater sectors so far. Water start-ups have understood that both are important to be competitive. New business models will, for instance, consider ‘the technology as a service’: technology is scalable faster, and can be adapted to the industry’s needs. The industrial end-users will then look with a different perspective at CAPEX and OPEX for water management.

Start-ups are also building on prospects and opportunities brought forward by other technological areas. Boundaries between sectors are progressively being blurred : let’s take 3 examples:

Energy — the development of renewable energy has opened considerable perspective for improving access to water in those areas where it has been too complicated and costly to build infrastructure. For example, we are seeing decentralized solar-based water and wastewater solutions coming onto the market. The challenge being still around the cost of produced water. Conversely, the cost of energy for advanced technologies should soon no longer be an issue. Energy efficiency and energy recovery are at the core of the many innovations: these do not only concern wastewater treatment plants, which are increasingly becoming carbon-neutral and/or energy-positive.

Digital — Many publications have already done excellent analysis, and the focal point here is that ‘non-water’ digital start-ups positioned on utility markets see water as an opportunity. The solutions developed by those start-ups can easily be transferred to the water sector, and bring a different integrated approach to resource management.

Circular economy — Turning wastewater into a resource is not new. However, using wastewater in unexpected sectors is innovative, like in transport (to produce hydrogen to power electric cars) and in the battery industry (to use brewery wastewater into energy storage cells). Materials in batteries have also inspired the development of a new desalination technology, still early stage today, yet with a huge market potential in the future.

There are many more examples, such as block chain applied to water, carbon recycling for membrane coatings, and application of 3D printing to treatment technologies. The revolution 4.0 in water should be inspired by these examples: cross-fertilization between sectors is very enriching and should really be encouraged.

The missing link is still finance

Despite massive research programs from all levels of government in different parts of the world, there is still a disconnect in the world of water between academia and the actual implementation of the research results on the field. When everyone agrees on the importance and on the economic potential of the water market, investment remains still low. And when it is said that investments are too small, we all should remember that this was the case with computer and software companies in the 1970/80s.

There is a reality out there, at least in Europe, that municipal markets are much more reluctant to go for innovations. The low price of water and the historical risk-adverse culture to innovation are still major hindrances. The introduction of the ‘Smart City’ concept, and the new EU public procurement rules are opening new options to encourage innovation without hampering competition and transparency. The EU Procurement Directive adopted in 2014 introduces Innovation Partnerships as a new procurement procedure. One will have to see how these will concretely be put into practice in the future. One key aspect: EPC contractors will be critically instrumental for a successful implementation.

This year will certainly see another wave of M&As in the water sector. And consolidation might be necessary at some point. In the meantime, there are many developments that should transform the actual landscape from rather conservative to innovative and dynamic. The future should be built on the different above mentioned elements, on the greater noticeable interest from large companies in innovative start-ups, on the growing awareness that existing technological solutions will be limited to address emerging quality and quantity challenges. The imperious needs to optimize costs, and the opportunities brought about by emerging markets can also be added. Finally, new technologies will create new markets. This is already happening in energy.

The energy retail market, often perceived as slow-moving, is evolving quickly in France. Start-ups are leading innovation into new business models, new services and customer engagement strategies, questioning EDF’s historical hegemony. The future looks full of new challenges and opportunities, for both new entrants and more established players.

The Nuclear Paradox

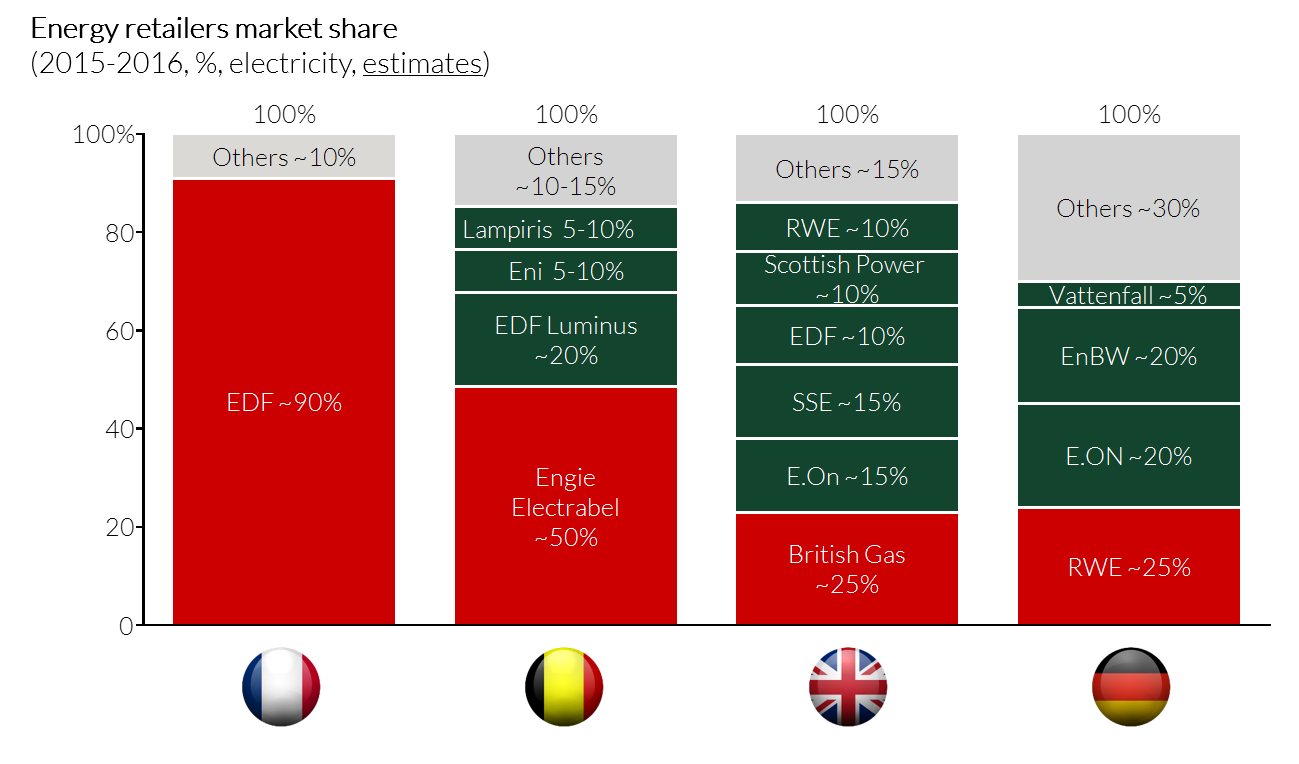

Deregulation of the French residential electricity market — fostered by various EU Directives — was fully completed in July 2007. Since then, 31 million customers can freely select their electricity provider, and are no longer required to contract with EDF, the French historical electricity producer and retailer. 10 years later however, it must be noted that EDF still holds a 90% market share on the electricity retail market and faces weak competition. Direct-Energie, EDF’s biggest and better-known competitor (mainly thanks to sizeable marketing campaigns created to educate the market on deregulation), today powers less than 2 million meters — still far from threatening EDF hegemony.

Other EU countries adopted similar national regulation in their respective domestic markets in the 2000s. In Belgium, Germany of the UK for instance, competitive landscapes now look much less concentrated than in France, with a few players capturing a 10–20% average market share each.

Certainly, the French market deregulation occurred later than in Germany, the UK or Belgium. Yet, we believe market conditions are more and more favorable for the French market to follow its neighbors’ lead — but why now?

Why now?

The opening of the retail electricity market will accelerate in the next few years due to the convergence of two main drivers:

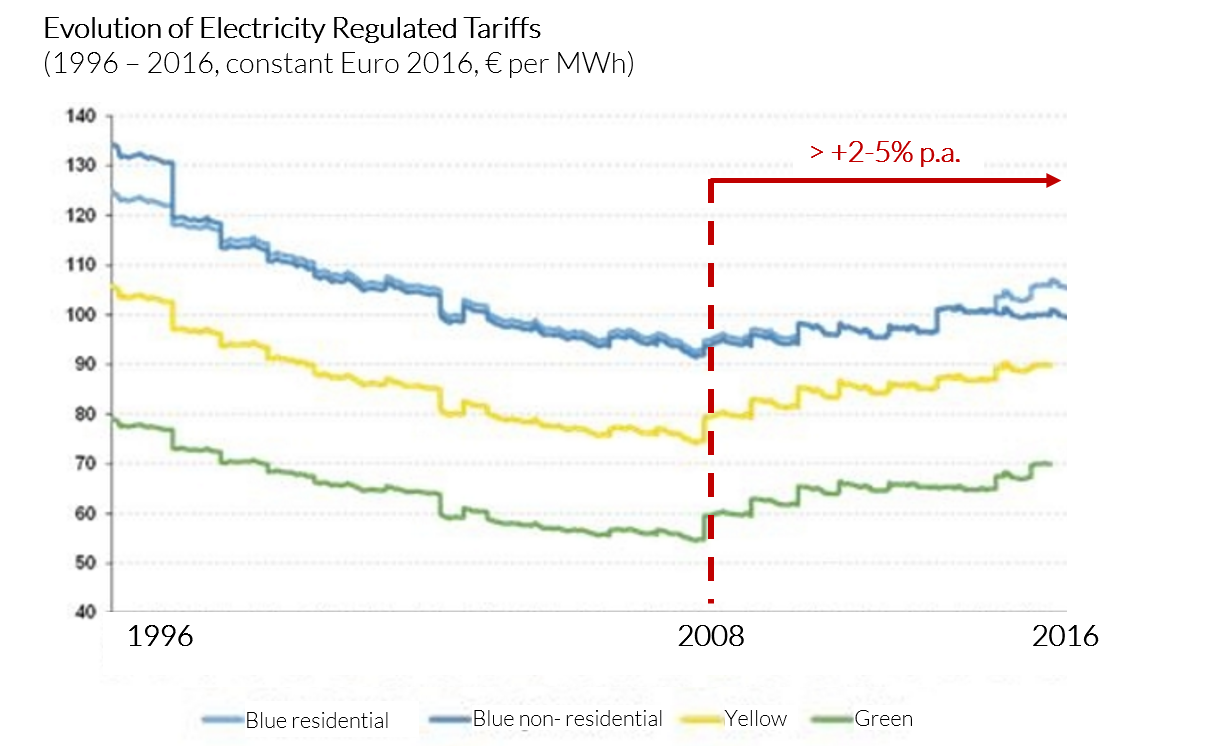

1. As Regulated electricity retail prices (TRV) keep on increasing, customers are looking for more competitive deals

Surprisingly enough, Regulated Tariffs charged by EDF have been steadily increasing by 2–5% per year since 2008 depending on customer consumption profile. Some increases in price can even occur retroactively: this summer €1bn were charged back by EDF to customers for a somehow illegal freeze in price in 2014–2015. At the same time, in a context of difficult economic conditions and high unemployment rate, switching to a new energy provider is becoming a mainstream “quick-win” option for households. It could yield savings up to a few hundred euros per year. Recent surveys show than more than 70% of customers switching to a new energy provider are primarily looking for more competitive offers.

Historically churn rate on the electricity market has been lower than gas. In 2016, for example, churn was 4% in the electricity market compared with 9% in gas. While this may appear limited, it represents a sizeable opportunity to capture more than 1.3m electricity meters per year. In other words, the French market could theoretically create a new Direct-Energie every year! In practice, things are slightly different: Direct-Energie is growing fast and captures a sizeable proportion of churners, while other players fiercely compete to capture customers that are less price sensitive and/or enticed with other value proposition components (e.g., green energy, etc.)

In a market where customers are looking for more transparency of information, intermediaries (aggregators like JeChange.fr, Souscritoo, Selectra and Group Sales like UFC-Que Choisir) have positioned themselves as a strong and cost-effective new customer acquisition channel for most retailers and are likely to get a more and more important role in the future.

“There is already a potential to create a new Direct-Energie every year”

2. Financial incentives for smaller players facilitate emergence of new offers

Several financial incentives have been developed by regulators during the past few years to accelerate market opening and induce new players and new business models into entering the market. They include:

- Direct Subsidies — For each energy retailer with less than 1.75m meters, Enedis (ex-ERDF) would grant €30/year/meter for 3 years to cover part of the costs related to the integration with their IT back-end

- “Bad-payers” costs — These costs are now partially supported by both energy retailers and distributors (vs. historically 100% supported by retailers)

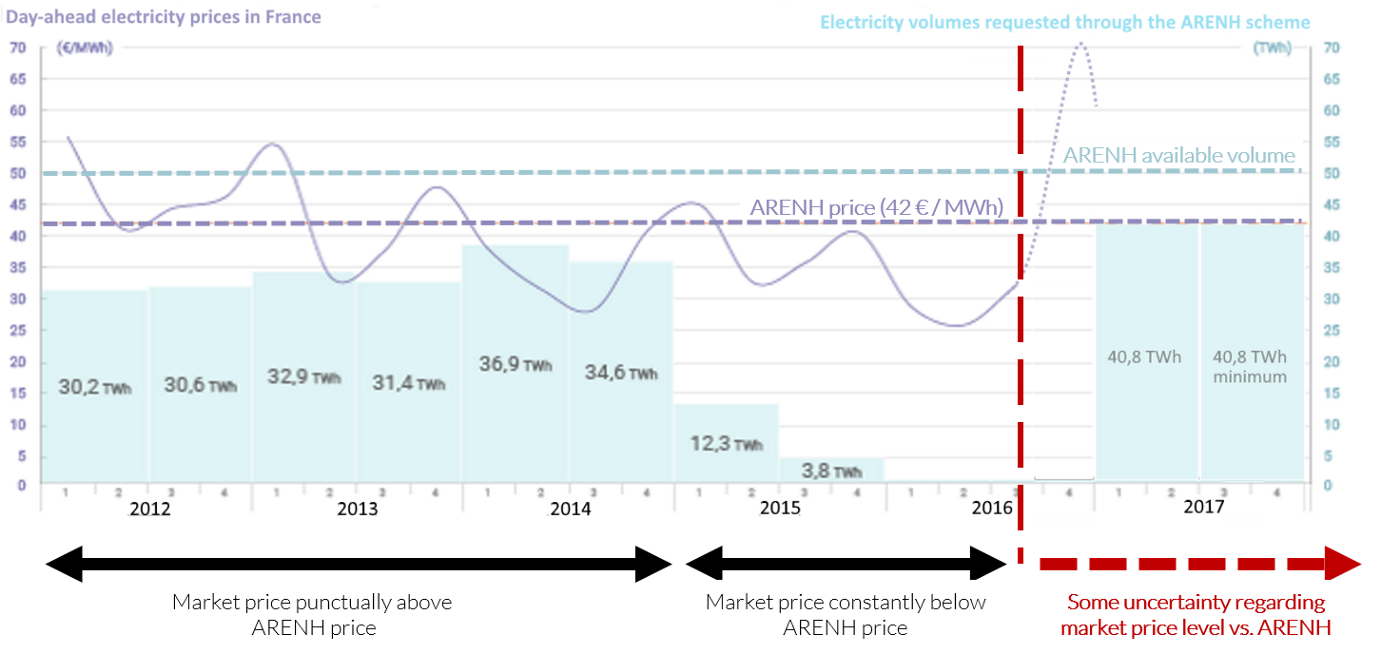

- Access to ARENH energy — Any retailer can have access to EDF nuclear energy at a fixed price of €42/MWh. This allows small retailers to hedge against market Spot price increase, which can show strong volatility (related to operating status of EDF nuclear plants or winter temperatures for instance). Used cleverly, the ARENH scheme provides a real security of supply for small retailers until they reach a critical size of approx. 50k meters. At that point, retailers are managing a large enough quantity of energy to efficiently forecast demand and plan purchasing strategy accordingly. ARENH access is limited to 100 TWh in cumulated volume. This is sizeable (20% of France total yearly consumption) and has historically always been undersubscribed by electricity retailers, even in periods when market prices were often above ARENH price.

“Used cleverly, the ARENH scheme provides a real security of supply for small retailers, until they reach a critical size of ~50k meters”

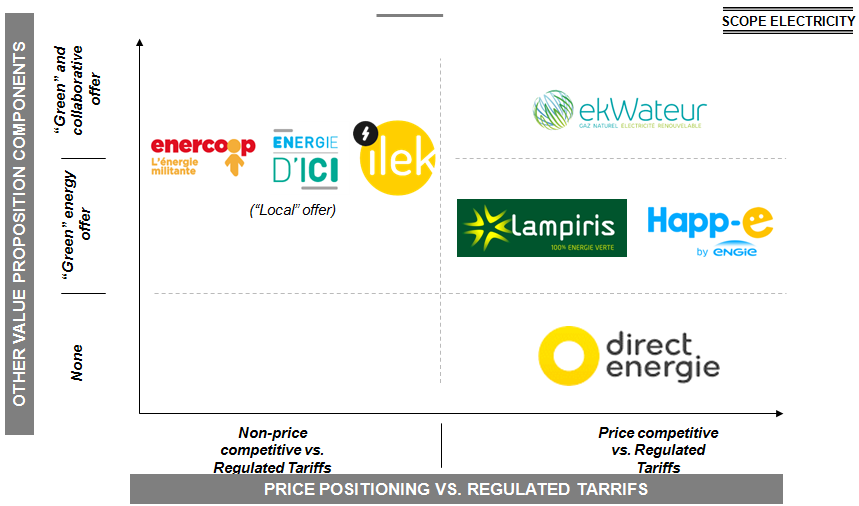

A new competitive landscape — who will survive?

In this context, alternative players have entered the market (and more and more will probably do in the future) with an ambition to differentiate themselves from EDF and capture as many churners as possible. As expected, most new players compete on price and offer a 5 to 10% discount vs. Regulated Tariffs, while those who don’t are very unlikely to succeed in building a sizeable portfolio of customers. In addition to price, new entrants also try to improve the value proposition to the end-customers by offering green (solar, wind, hydro), locally-sourced and/or collaborative energy, with mixed success to date.

Gross margin on pure energy retail business is constrained by sizeable fixed costs (taxes, transport cost, etc.) and don’t exceed 5–10% of sales. This leads to two main “must-have” achievements for alternative players to survive:

- Mandatory critical mass (>50–100k meters) must be reached quickly for new entrants to cover fixed costs, improve energy consumption forecast and build effective procurement strategy accordingly, and achieve independence from ARENH. Not all players will be able to do it fast.

- Development additional services should be a cultural mandate for all new entrants. These can include insurance products, boiler installation / maintenance, trusted intermediary (market place) for household energy efficiency investments (insulation, solar, smart thermostats, etc.) and other premium services. In addition to improving customer stickiness and generating actionable customer date for retailers (e.g., smart home devices), they should become a strong margin contributors and change electricity retailers “traditional” P&L.

“Quickly reaching a critical size and effectively selling additional high-margin services are two “must-have accomplishments” for new entrants”

Within a 5 to 10-year period, successful new players will all be cheaper than Regulated Tariffs, and will differentiate from one another with alternative energy supply offers and/or innovative additional services.

As of today in Europe and the US, around 300 startups are active within the smart parking sector. By screening them it becomes clear that the key business model for start ups targeting services for on- and off- street parking is transaction fees based. A little analysis suggests that pure information/guidance and detection companies won’t be paid for these services in the near future.

In general theses products and services are aimed to minimize parking cruising and reduce traffic due to parking, while reducing OPEX & CAPEX expenditures for cities and increasing parking operators revenues. The market for on- and off- street parking is huge and amounts to around $30B each in Europe and the US, with two-third of the market being off-street parking revenues. The Chinese market is still nascent at around $1B but growing at around 30% per annum, whereas the US and European markets grow only by 1–3% per annum. The pure transaction based slice of that market — taking around 3–5% in transaction fees — will amount to approx. $2–3B in the coming years. Additional markets are Peer to Peer marketplaces and B2B analytic platforms for parking operators.

The smart parking sector can be categorized in transaction fees or B2B platform

In fact the smart parking sector can be categorized into six segments. The first four of them a) info, payment and booking b) e-payment c) on-street guidance and detection and d) Peer to Peer Parking (P2P) platforms make money based on transaction fees. The last two — valet and B2B analytic platforms — have a different business model. The trends of the various segments are outlined below.

Info, payment and booking for on- and off-street parking

Which player has the most parking spaces upon it’s platform? Here a race is occurring. The two largest global players are Inrix and Parkopedia. Both have started with on-street parking data/information and are now also including off-street parking info combined with payment and booking. Currently, automotive companies are willing to pay around 1–2$/year/car for integrating those services into the car infotainment subscription services. Assuming that around 200–300m connected cars will be on the streets within the next 5 years, the market size is relatively small. Therefore, and due to competitive forces, both players are now also including payment services to take transaction fees. This becomes especially interesting when “cars” will automatically pay for parking. Thus the trend is that in the near future pure info platforms will provide such data for free and all players will make $s by taking a transaction fee.

Pure e-payment focused companies for on- and off- street parking

Here, three players are already dominating the market i.e.: a) Easypark, majority owned by Verdane Capital, a private Equity company — potentially looking for an exit, b) PaybyPhone, acquired by Volkswagen AG in December 2016, with approx. $350m in gross revenues and c) Parkmobile, the US entity is owned by the Dutch business travel group BCD, the European entity is owned by BMW. Given the trend in the connected vehicles, these platforms are also including automated booking and information systems about parking, and as such will enter the space of the first segment.

On-street guidance and detection

In this segment, a small amount of startups are active: they crowd-source parking data through smart phone sensors, sometimes combined with dedicated hardware-based sensors, statistics and/or parking regulations/location information. This either feeds directly into their own proprietary apps and/or they provide a Software Development Kit (SDK) for other apps based on their data/algorithms. Making money on this services is not evident and those platforms need to pivot into transaction fees as well.

P2P platforms

This model is straightforward as these platforms are parking aggregators of private or business owned parkings to make them available/bookable for other individuals. All these platforms make money by taking a transaction fee. Here, scalability is key, i.e. getting as many parkings online for the lowest customer acquisition cost (CAC) per parking. Many startups are active and as such the sector is ready for a market consolidation.

Valet parking

Various startups were founded in this sector in the US during the last years. Almost all failed (Vatler, Caarbon and Luxe) or pivoted to a totally different area ( Zirx to Stratim). Only one “Valet Anywhere” is still active and offers valet services for monthly subscribers. All of them underestimated the relative high CAC combined with high cost for the valet man force, with very limited economies of scale (there are only 1–2 parking events one person can handle per hour) plus unpredictable demand. In addition, expected discounts with parking operators where not achieved as demand was highest during their peak hours. Often parking spots had to be prepaid regardless of usage. Similar Valet startups are “popping” up in Europe since 2015. We expect that the history as in the US will repeat itself. This segment just doesn’t scale unfortunately.

B2B, data analystics, SaaS

These startups are focusing to increase the yield of parking operators and/or provide parking information for e-payment providers. Especially the ones improving the yield of operators are promising as most are still using excel sheets or even more simpler models. A promising one out of the US in this segment is Smarking .

From an investor point of view, the interesting bets within key segments have already been taken. Interesting investments can still be made within the B2B analytic platforms business segment.